Sheen Resources

Filing an accident claim should be done as soon as possible after a car accident. Most insurers expect you to lodge your insurance claim within days; some set strict limits such as 28–30 days. Acting quickly helps your insurer assess the damage, support your claim, and get your repairs underway.

A 42% increase was recorded in the average motor claims between 2019 and 2024 (Insurance Council of Australia). Knowing how long you have to file an insurance claim — and what steps to take — can save you stress and money. At Sheen, we repair your vehicle and help you figure out how car insurance works so you’re not left dealing with insurers alone.

How long do you have to file an insurance claim?

Most insurers recommend lodging a claim as soon as possible after an accident. While some providers don’t set a strict deadline, others impose time limits that can affect whether your car insurance claim is accepted. Acting quickly also helps your insurer investigate the accident, assess repairs, and avoid disputes later.

Here are the typical time limits for making a claim with major Australian insurers:

Even if your insurer doesn’t specify a cut-off, it’s best to file your claim as soon as possible. The General Insurance Code of Practice also requires insurers to confirm the status of your claim within 10 business days, provided you’ve submitted all the necessary information.

If you’re unsure about your car insurance policy, always check your PDS (Product Disclosure Statement) or contact your insurer directly. And if you’d like help getting your claim started, Sheen can liaise with your insurer while organising repairs and replacement vehicles, giving you one less thing to worry about.

Key steps to support your insurance claim

The claims process doesn’t just begin after the accident. It starts with preparation and continues until your car is repaired. Here’s a timeline of what to do before, during, and after an incident to make sure your insurance claim is as smooth as possible.

Prepare before an accident happens

Review your car insurance policy and read your product disclosure statement (PDS) so you understand your cover, exclusions, and claim time limits. Keeping a dash cam and storing your insurer’s claims contact details in your phone can also save time if you ever need to lodge a claim.

Gather evidence immediately after the accident

The first actions you take will directly support your claim:

- Take photos of the scene, vehicle damage, and licence plates.

- Record details of the accident (time, date, location, weather).

- Collect witness statements and save dash cam footage if available.

Protect your claim by avoiding common mistakes

Don’t admit fault at the scene. A casual comment can be treated as liability and impact your car insurance claim. Insurers will determine responsibility, so focus on collecting accurate details.

Call Sheen for repairs and insurer support

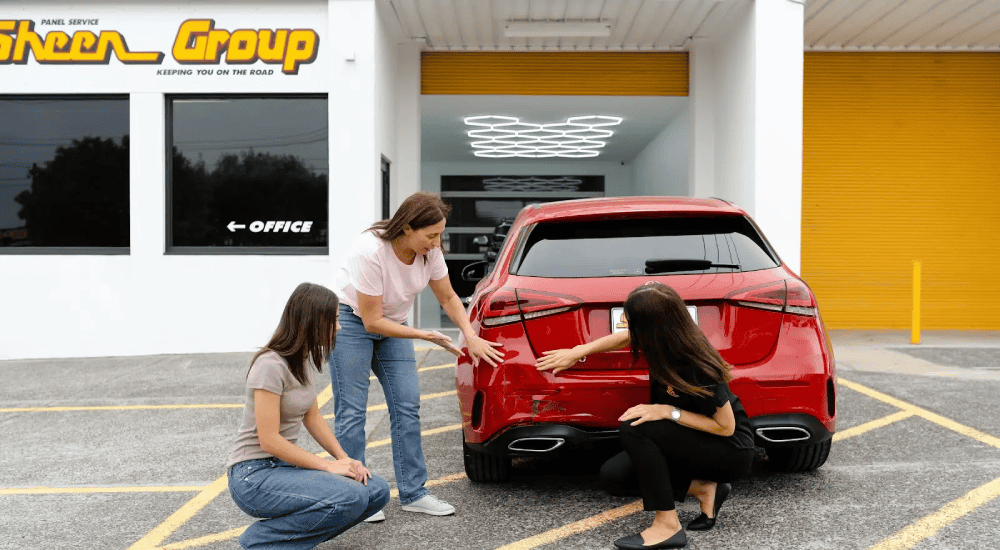

Sheen can organise towing, repairs, and an accident replacement vehicle if your car isn't drivable. Our team can also liaise with your insurer to help start your claim and reduce stress. As accredited members of the VACC, Sheen workshops meet strict industry benchmarks for quality, safety, and customer service.

Our quotes are always independent, and there’s no obligation to proceed. If you choose, we’ll also negotiate with your insurer on your behalf, ensuring your claim is handled fairly without extra hassle for you.

Track your claim in the weeks following

Once lodged, your insurer should confirm the status of your claim within 10 business days, in line with the General Insurance Code of Practice. If your car is in for repairs, Sheen will ensure work is completed as agreed. You may need to pay an excess when collecting your vehicle if you are at fault.

[upload_smash][/upload_smash]

Why call Sheen first for accident repairs and claims

When you’re involved in a car accident, you don’t just need repairs — you need someone who understands the entire claims process. That’s where Sheen can help. Recognised among Melbourne’s best accident repair networks, Sheen combines expert panel beating, towing, and insurance support for popular brands like Toyota, Mazda, and Hyundai.

- We repair your vehicle with manufacturer-approved methods through our panel beating service.

- We work directly with insurers through our insurance services, eliminating the hassle of lodging your claim.

- If your car can’t be driven, we’ll organise towing services and set you up with a replacement vehicle to keep you moving.

Many drivers wonder whether to contact their insurer or a repairer first after an accident. By calling Sheen first, you’ll have expert support through every stage of the claims process, from lodging your claim to driving your car home again.

With transparent guidance and quality repairs, we make sure your claim is handled smoothly and your car is restored without unnecessary stress. Contact Sheen today to get your claim started and get back on the road sooner.

[nearest_workshop][/nearest_workshop]

Common questions about car insurance claims

How long after an accident can I lodge a car insurance claim?

You should lodge your car insurance claim as soon as possible. Some insurers set strict limits of 28–30 days, while others simply expect prompt action. Always check your car insurance policy or read the product disclosure statement (PDS) to confirm how long after an accident you can make a claim.

Can I make a car insurance claim online?

Yes. Most insurers now allow you to start your claim online. You’ll usually need to complete a claim form, provide information about the accident, and upload evidence such as photos or dash cam footage. This helps the claims team get your claim started faster and provide updates on the status of your claim.

What can I claim under different car insurance policies?

It depends on your cover. Comprehensive car insurance usually pays for loss or damage to your car and others. A CTP insurance claim only covers personal injury from a motor vehicle accident. To check what you can claim, always review your insurance products and look for exclusions to your cover in your PDS.

What if my insurer rejects or delays my claim?

You can escalate the issue if your claim is lodged and you’re unhappy with the outcome. First, contact your insurer’s claims team. If it isn’t resolved, you can lodge a dispute with the Australian Financial Complaints Authority, which reviews claims made under general insurance.

.png)

.png)